new mexico solar tax credit form

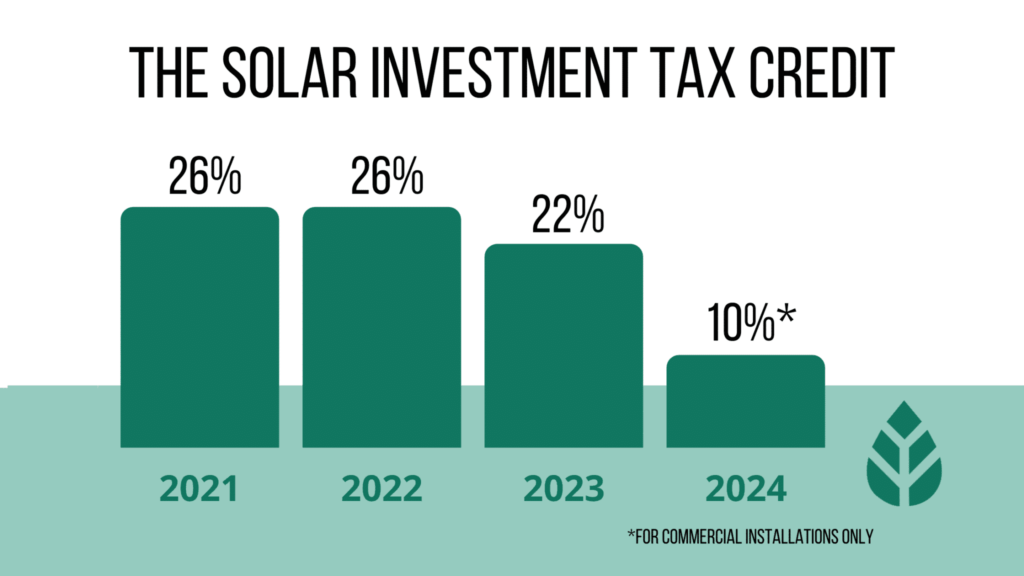

The likely best solar incentive for property owners in New Mexico is the states solar tax credit. Buy and install new solar panels in New Mexico in 2021 with or without a home battery and qualify for the 26 federal solar tax credit.

Federal Solar Tax Credit A Homeowner S Guide 2022 Updated

QUALIFICATIONS FOR REBATES AND CREDITS REPORTED IN SECTIONS II TO V.

. Complete Section I to claim the following rebates and credits in Sections II through V. State of New Mexico - Taxation and Revenue Department RENEWABLE ENERGY PRODUCTION TAX CREDIT CLAIM FORM ____ ____ ____. The federal solar tax credit.

Each year after it will decrease at a rate of 4 per year. The Solar Market Development Tax Credit provides a tax credit of 10 for small solar systems including on-grid and off-grid PV systems and solar thermal systems. Local Building Authority.

Form TRD-41406 New Solar Market Development Tax Credit Claim Form is used by a taxpayer who has been certified for a new solar market development tax credit by the Energy Minerals and Natural Resources Department. It is taken in the tax year that you complete your solar install. New Mexico state tax credit.

Yes the State of New Mexico has many solar incentives available to homeowners in 2022. 1Name MFirst Name I Last Name Phone Number with Area Code. Tax Credit Forms Directions 1.

The solar market development tax credit may be deducted only from the taxpayers New Mexico personal or fiduciary income tax liability. 12790 Approximate system cost in NM after the 26 ITC in 2021. Name Administrator Budget Last Updated End Date DSIRE ID Summary.

The balance of any refundable credits after paying all taxes due is refunded to you. It covers 10 of your installation costs up to a maximum of 6000. In 2020 New Mexico lawmakers passed a statewide solar tax credit called the New Solar Market Development Income Tax Credit.

The process to claim the New Mexico solar tax credit is simple. This tax credit is based upon ten percent of the solar system value and is available for solar thermal and photovol taic solar systems. The balance of any refundable credits after paying all taxes due is refunded to you.

To claim any refundable tax credits in Section VI you do not need to complete Section I. For instance if your New Mexico solar. New mexico solar tax credit form.

Allow the pop-ups and double-click the form again. Claiming the New Mexico Solar Tax Credit. Enter up to three credit certificates and the amount of credit applied to tax.

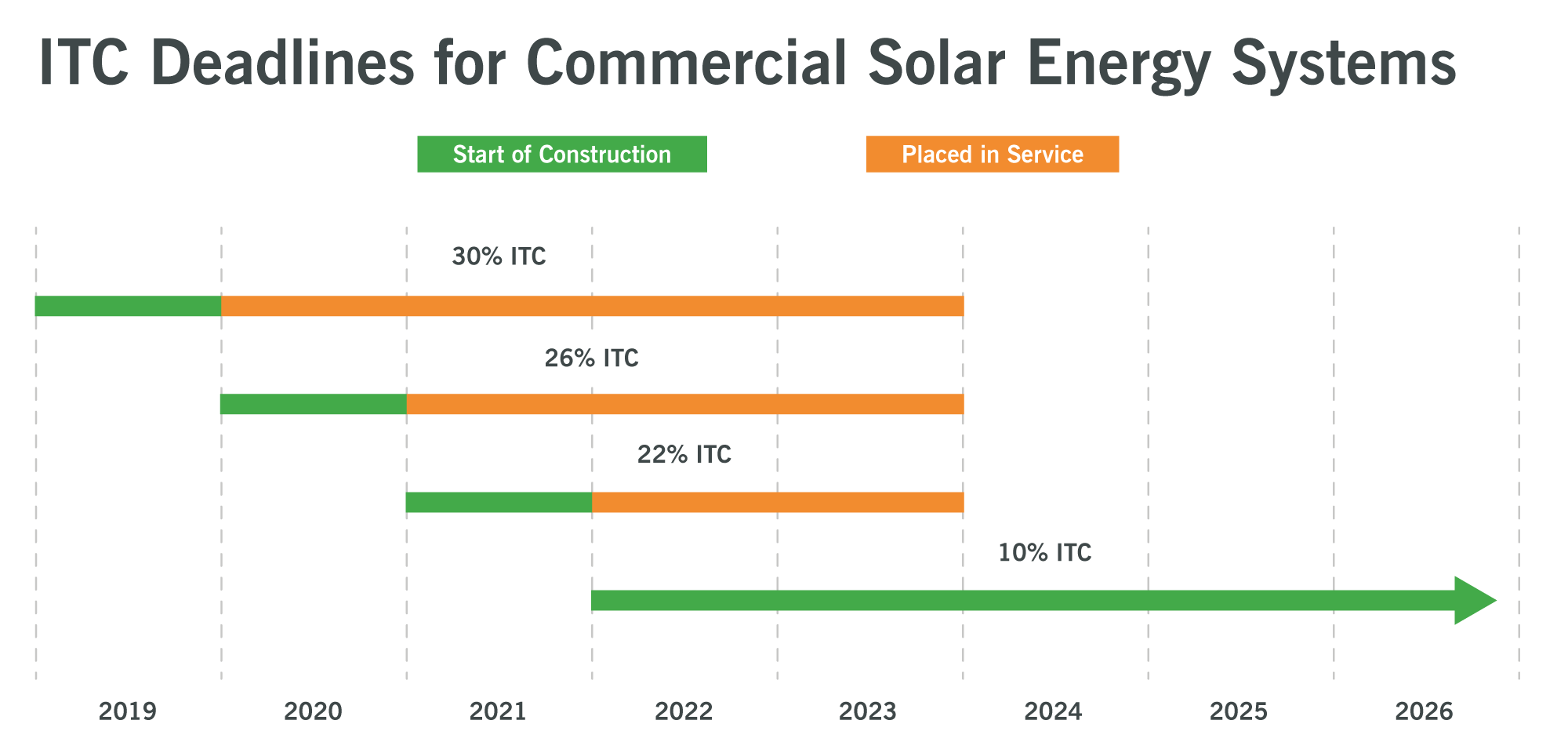

12790 approximate system cost in nm after the. The Residential Solar Investment Tax Credit ITC for the total cost of solar installation goes until 2019 at 30. The starting date for this tax credit is March 1 2020 and the tax credit runs through December 31 2027.

However it can take some time. Since most average sized 6kW systems cost about 18000 you can expect a credit of about 1800. 364 New Mexicos Energy Efficiency and Renewable Energy Bonding Act which became law in April 2005 authorizes up to 20000000 in bonds to finance energy efficiency and renewable energy.

See form PIT-RC Rebate and Credit Schedule. Form BCA Residential Solar NMAC 3314 Solar System Installation Form- BCA New Solar Market Development Income Tax Credit Form BCA Asterisk indicates required information. While the federal ITC is worth 26 percent of the cost of your installation the New Mexico solar tax credit caps out at 10 percent of the cost or 6000 whichever is less.

SOLAR MARKET DEVELOPMENT TAX CREDIT CLAIM FORM Enter the credit claimed on the tax credit schedule PIT-CR or FID-CR for the personal income tax return Form PIT-1 or the fiduciary income tax return Form FID-1. The New Solar Market Development Income Tax Credit forms. There are two solar tax credits.

New Mexico state solar tax credit. The PIT-RC Rebate and Credit Schedule is a separate schedule to claim refundable credits. The New Mexico Energy Minerals and Natural Resources Department EMNRD.

New mexico solar tax credit 2020 form Monday February 21 2022 Edit Husband And Wife Age 40 And 38 Living In Bronte Ontario The Husband Is A Tax Lawyer At A Law Firm. Form 4 ST Tax payer and Contractor Statement of Understanding. Clean Energy Revenue Bond Program.

Expand the folders below or search to find what you are looking for. 7 Average-sized 5-kilowatt kW system cost in New Mexico. Double-click a form to download it.

This incentive can reduce your state tax payments by up to 6000 or 10 off your total solar energy expenses whichever is lower. This solar incentive takes off up to 6000 or 10 of your total solar system expenses from your state tax payments. Youll find this credit in Business Credits within the New Mexico portion of TurboTax.

However this amount cannot exceed 6000 USD per taxpayer in a financial year. Signature of taxpayer Date RPD-41317 Rev. The residential ITC drops to 22 in 2023 and ends in 2024.

You will then file for the tax credit with your tax return before April the following year using the Form 5695. So the ITC will be 26 in 2020 and 22 in 2021. 5 rows Signature of taxpayer Date RPD-41317 Rev.

New Mexico Finance Authority. NM Taxpayer Information. New Mexico provides a number of tax credits and rebates for New Mexico individual income tax filers.

The state tax credit will be available until the end of 2027 but is offered on a first-come first-served basis. The process requires some certifications and filling out forms which can extend the timeline. Multiply line 5 by line 6.

Form BCA Solar Themal System Installation Form. For property owners in New Mexico perhaps the best state solar incentive is the states solar tax credit. 07152015 State of New Mexico - Taxation Revenue.

The tax credit applies to residential commercial and agricultural installations. Form 5 BusinessLLCLLP Form. If the credit amount surpasses your tax amount for the taxable year the remaining credit can be carried over for the next five years.

This incentive applies to homes farms and business installations. The state tax credit for 10 of your solar panel system cost and the federal tax credit for 26 of your system cost. Form 3 Solar Thermal System Installation Form.

Fill Out the Application. New Mexico State Solar Tax Credit. New Mexico provides a number of tax credits and rebates for New Mexico individual income tax filers.

Your browser may ask you to allow pop-ups from this website. Form BCA Solar PV System Installation Form. There is a cap of 8 million in tax credits to be issued every year on a.

This is the amount of renewable energy production tax credit that may be claimed by the claimant for the current tax year. For example if you buy a huge solar installation that comes out to 80000 your tax credit will stop at the 6000 limit. NEW MEXICO REBATE AND CREDIT SCHEDULE SECTION I.

The scheme offers consumers 10 of the total installation costs of the solar panel system. The New Solar Market Development Income Tax Credit was passed by the 2020 New Mexico Legislature. Form 4 PV Tax payer and Contractor Statement of Understanding.

It provides a 10 tax credit with a value up to 6000 for a solar system.

Oil Companies Are Collapsing Due To Coronavirus But Wind And Solar Energy Keep Growing The New York Times

Contact Manager Address Book Software Quote Template Be An Example Quotes Web Design Quotes

Federal Solar Tax Credit 3 Common Misconceptions Iws

Japan Sets Feed In Tariffs For The 2020 Japanese Financial Year Pv Tech

Federal Tax Credit For Hvac Systems How Does It Work And How To Claim Step By Step Instructions

How To Calculate The Federal Solar Investment Tax Credit Duke Energy Sustainable Solutions

Federal Tax Credit For Hvac Systems How Does It Work And How To Claim Step By Step Instructions

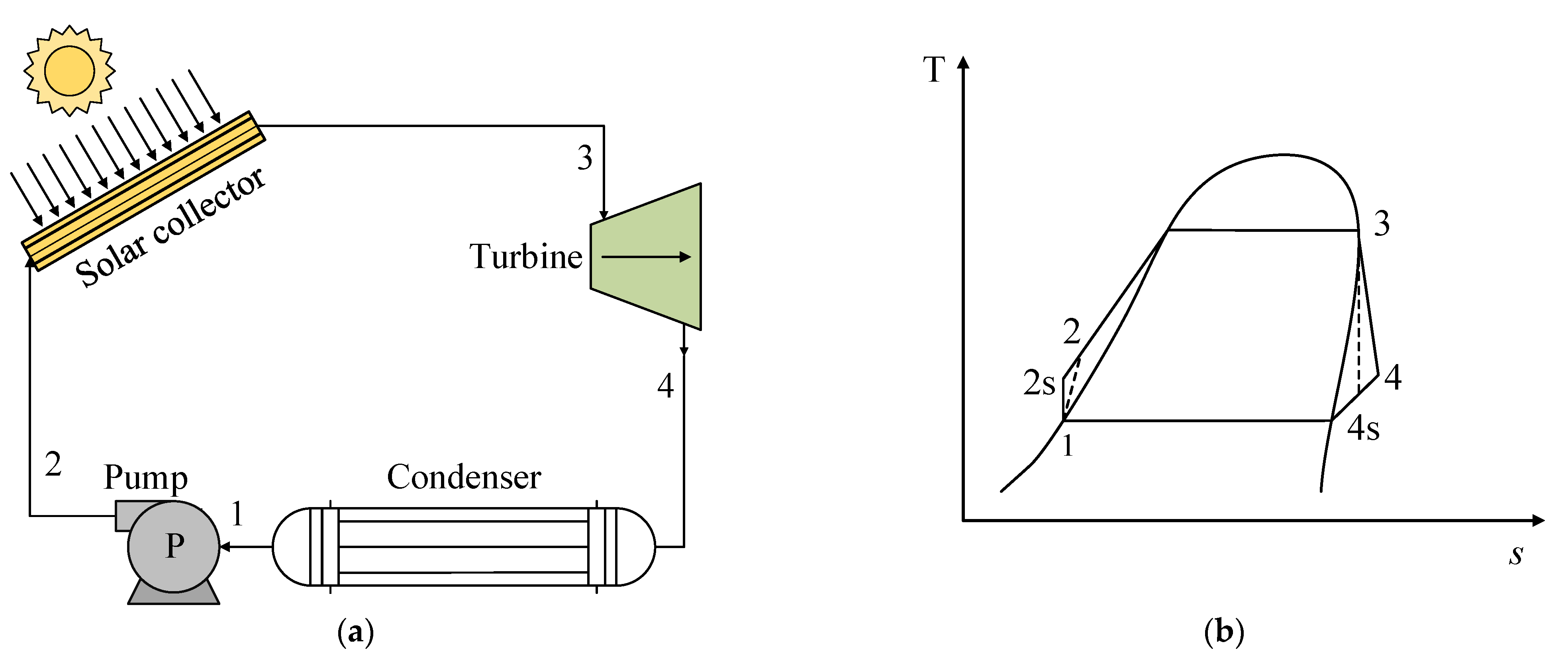

Sustainability Free Full Text A Review Of Recent Research On The Use Of R1234yf As An Environmentally Friendly Fluid In The Organic Rankine Cycle Html

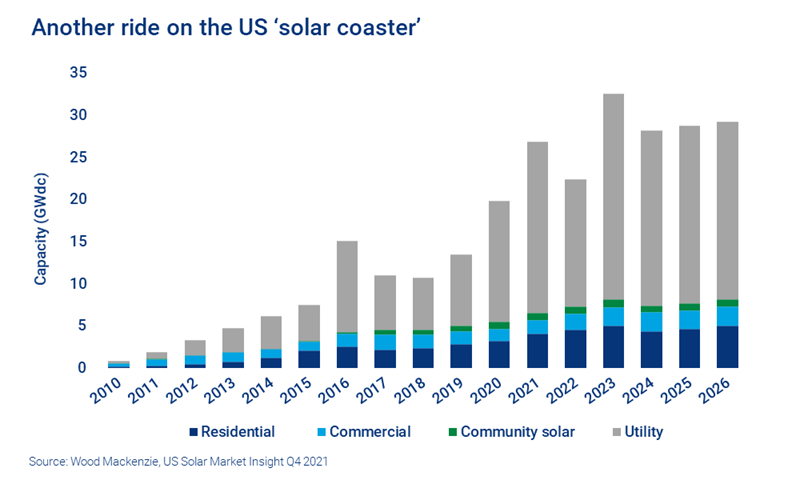

Solar Pv Installations To Continue Surge In Us As Costs Fall Ihs Markit

Redefining The Us Solar Coaster Wood Mackenzie

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

Federal Solar Tax Credit A Homeowner S Guide 2022 Updated

Tax Credit Info Daylighting Systems Solar Powered Fans Solatube